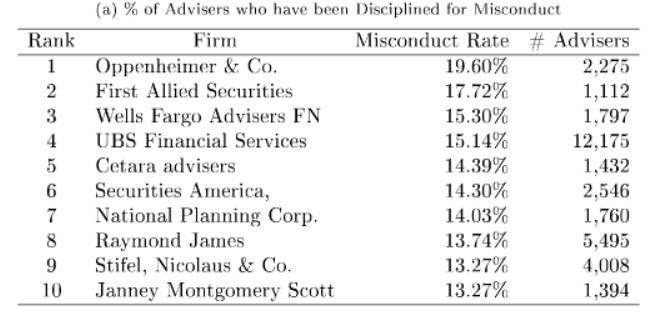

A new working paper by business school professors at the University of Chicago and University of Minnesota found that 7 percent of financial advisers have been disciplined for misconduct that ranges from putting clients in unsuitable investments to trading on client accounts without permission.

“It’s everywhere, not just small firms. It is pervasive,” said Amit Seru, a finance professor at the University of Chicago’s Booth School of Business and a co-author of “The Market for Financial Adviser Misconduct.”

“This is a truly shocking study”, said Frank Beck, President and Chief Investment Officer of Beck Capital Management LLC. “We knew there were problems in our industry, but not to this degree. Especially surprising is that firms like Oppenheimer, Wells Fargo and UBS have had more than 15% of their advisers disciplined for misconduct.”

For the full story, click here.