ECONOMY

In March 2009, the Fed began its “shock and awe” experiment with “quantitative easing” (QE-1) buying $1.75- trillion in Treasury and mortgage backed securities (MBS’s). The fed funds rate was slashed to 0.25%, yet US-banks weren’t lending the excess cash to the private sector. Even after the first round of QE ended in March of this year – and nearly a year after the recession “technically” ended in June of 2009 – the US-economy is still sputtering. Now it appears the Fed will begin QE-2, likely purchasing between 0.5 and 1.5 trillion dollars of Treasuries, mostly of longer maturities. Treasury bond yields already reflect the expectation of a half trillion dollar QE-2 with the 5-year yielding only 1.1% and the 10-year now below 2.4%. It will take more than that amount to drive rates lower still, further decreasing the value of the already devalued dollar – the apparent plan coming from Washington.

In March 2009, the Fed began its “shock and awe” experiment with “quantitative easing” (QE-1) buying $1.75- trillion in Treasury and mortgage backed securities (MBS’s). The fed funds rate was slashed to 0.25%, yet US-banks weren’t lending the excess cash to the private sector. Even after the first round of QE ended in March of this year – and nearly a year after the recession “technically” ended in June of 2009 – the US-economy is still sputtering. Now it appears the Fed will begin QE-2, likely purchasing between 0.5 and 1.5 trillion dollars of Treasuries, mostly of longer maturities. Treasury bond yields already reflect the expectation of a half trillion dollar QE-2 with the 5-year yielding only 1.1% and the 10-year now below 2.4%. It will take more than that amount to drive rates lower still, further decreasing the value of the already devalued dollar – the apparent plan coming from Washington.

For Geithner, the White House, and Congress to suggest that a stronger yuan will make Chinese goods less competitive on the world stage (thus supposedly making ours more desirable) is the equivalent of a restaurant chef arguing that a shorter minute would reduce the amount of time necessary to cook a soufflé. In truth, money is only a veil, and if the yuan rises even more against the dollar, Chinese goods will continue to arrive here (thankfully) en masse much as Japanese goods did after 1971 when the yen began a 20-year climb against the dollar.

This is the case because while goods priced in yuan will be more expensive in dollar terms, the costs of goods necessary to manufacture Chinese products will by definition decline. In yuan terms everything will become cheaper for Chinese manufacturers, which means any yuan strength will be mitigated by reduced costs of production.

Absent a strong yuan appreciation, it’s possible that Congress will start a trade war that history says will prove unfortunate for  stocks. Assuming a revaluation, a cascading dollar promises much the same.

stocks. Assuming a revaluation, a cascading dollar promises much the same.

Whatever the end result, gold is a go-to currency and is only expensive insofar as the dollar is very cheap. Washington is playing with currency fire right now, and sadly there’s no good outcome to hope for short of another currency crisis that leads to voter demand for a unit of account (a new currency) that is actually credible.

Another of the most important near term risks to the outlook is fiscal policy and, more specifically, the prospects for extension of expiring tax and benefit provisions. Roughly $270 billion in tax cuts are scheduled under current law to expire on December 31st. With the expectation of continued class warfare being waged by Washington, our forecast assumes that Congress extends the majority of these provisions, with only upper-income tax cuts left to expire. To gain the few Republicans needed to pass in the Senate, the “upper-income” might be raised from $250,000 to $1,000,000. However, with essentially no congressional action to date, the prospects for such an extension are uncertain so the extent of the tax hikes is still unknown. (With higher taxes likely, if you are considering a Roth conversion, you have slightly over two months left to take advantage of the two-year deferral of tax payments).

INVESTMENT OPPORTUNITIES

There are very few Apples, so investment opportunity, today, requires finding companies that are selling to the emerging markets or have needed resources or strategic hard assets. I’ve discussed emerging markets, high dividend stocks, hard assets, and natural resources in recent issues. This month I would like to discuss our recent (August) additions to our portfolios. They are off to a great start and I expect them to continue to do very well for several years. I am talking about our rare-earth mining companies.

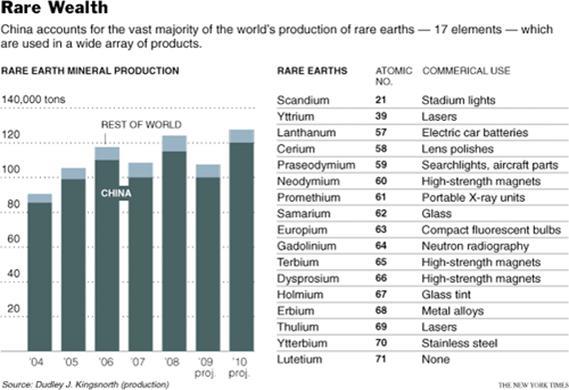

RARE EARTH METALS

Maybe you’ve never heard of rare earth metals, but you use them every day of your life. They’re used in things like cell phones, semiconductors, lasers, fiber-optic cable, plasma TVs, hybrid cars, microwave ovens, and scud missiles. They — and just about anything electronic — contain some of the most obscure chemical elements on the planet known as rare earth metals.

Rare earth elements are actually not rare, with the two least abundant of the group 200 times more abundant than gold. They are, however, hard to find in large enough concentrations to support costs of extraction, and have an inhibitor in radioactive thorium which must be properly disposed.

The United States Geological Survey (USGS) has identified 17 elements that are considered rare earth metals, but nobody paid much attention to them until recent years because of the development of new technologies and electronic devices.

All high-tech military gear and most of the world’s advanced medical, and high-tech electronics simply won’t work without rare earth metals. These metals have very special physical and chemical attributes, including high degrees of magnetism, luminosity, superconductivity and environmental non-toxicity.

Rare earths are as strategically important as oil, copper, uranium, natural gas, and coal, yet until recently there was not much opportunity to invest in them. Ten years ago, the world used 40,000 metric tons of rare earth metals a year. Today, the world uses 125,000 tons, but is expected to grow to over 200,000 tons by about 2014 and projections are for demand to outstrip supply in the next few years. It isn’t that rare-earth metals are all that rare. The real issue is that for years China mined most of them and used very little. That has changed. China still mines more than 95% of all the rare earths mined each year, but they have moved from a marginal user, to the largest user in the world.

The U.S. Magnetic Materials Association said, “It is estimated that Chinese domestic consumption of rare earth materials will outpace Chinese domestic supply between 2012 to 2015. It is unclear whether rare earth material will be available outside China in the coming years.”

Recently, China’s Ministry of Industry and Information Technology announced that they are considering a total ban on exports of terbium, dysprosium, yttrium, thulium, and lutetium. It’s part of a plan that Deng Xiaoping started almost two decades ago when he said that rare earth metals would “Do for China what oil did for Saudi Arabia.” Can you imagine a government that actually makes decades long plans for economic growth? We should demand the same – our politicians (R’s and D’s) seem focused on only decades long entitlements.

The General Accounting Office said that the U.S. produced zero rare earth elements in 2009 and that it will take up to 15 years to rebuild our own domestic rare earth supply chain. “The United States has the expertise, but lacks the manufacturing assets and facilities to refine oxides to metals. Refined metal is almost exclusively available from China,” states the GAO.

In June of 2009, the U.S. House of Representatives passed HR 2647, the National Defense Authorization Act (NDAA). Section 828 of the Act included language concerning “the availability of rare earth materials and components containing rare earth materials in the defense supply chain.”

Section 828 noted that “less common metals” such as the rare earths and thorium were “critical to modern technologies, including numerous defense critical technologies and these technologies cannot be built without the use of these metals and materials produced from them and therefore could qualify as strategic materials, critical to national security.”

Rep. Ike Skelton, chairman of the House Armed Services Committee, said “China is a rapidly rising military and economic power and the fact is that they cornered the market on these rare earth metals that are essential for a lot of our advanced weapons systems as well as a lot of manufacturing in the United States.”

Reuter’s News Services notes:

The demand for dysprosium, terbium, neodymium, praseodymium and europium is set to grow by a minimum of 8 percent a year. Electric vehicle demand for dysprosium, neodymium and praseodymium is set to grow by an average of 790 percent in the next five years.

BOTTOMLINE:

I expect we will maintain and add to these positions over several years.

Frank

512.345.6789

———————————————————————————————————————–

Information included in this electronic newsletter is not to be taken as investment advice. The information is general in nature and may not be appropriate for your individual situation.

The comments, graphs, forecasts, and indices published in Stock Market View are based upon data whose accuracy is deemed reliable but not guaranteed. Performance returns cited are derived from our best estimates but must be considered hypothetical inasmuch as we have investors who enter various investments at different times. If you have a friend, co-worker or family member who you feel could benefit from Stock Market View, please feel free to forward this edition.

To make sure you don’t miss our urgent updates, add Frank@FrankBeck.com to your address book.

If you have received this from a friend and would like to receive the next six issues at no cost or obligation, please send an email to FreeStockMarketView@FrankBeck.com (you may click on the link to send the message).

Please feel free to share this letter with friends, in its entirety only.

Copyright Warning and Notice: It is a violation of federal copyright law to reproduce all or part of this publication or its contents by any means. The Copyright Act imposes liability of up to $150,000 per issue for such infringement.

Disclosure: Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Frank Beck & Beck Capital Management explicitly disclaims any responsibility for product suitability or suitability determinations related to individual investors. The investment products discussed herein are considered complex investment products. Such products contain unique risks, terms, conditions and fees specific to each offering. Depending upon the particular product, risks include, but are not limited to, issuer credit risk, liquidity risk, market risk, the performance of an underlying derivative financial instrument, formula or strategy. Return of principal is not guaranteed above FDIC insurance limits and is subject to the creditworthiness of the issuer. You should not purchase an investment product or make an investment recommendation to a customer until you have read the specific offering documentation and understand the specific investment terms and risks of such investment.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.