The Long-Term and the Short

I always emphasize the macro economy and its importance in making sound investment decisions and at this unique time it may warrant added consideration. With the developed economies’ governments and central banks having overspent, overpromised, and overprinted, the environment is unlike that which we have ever seen on a world-wide basis. While the developed countries central bankers print money to pay for spendthrift governments, the developing world’s central bankers are trying to slow their economies and deal with inflationary pressures. In the past, it was always developing economies or those of war-defeated countries that printed their way into hyperinflation – this time it is the developed countries who are nearing the tipping point.

The ending of QE2 (Fed’s 2nd phase of Quantitative Easing or money-printing in layman) has brought a significant, although I believe it will prove brief, contraction in commodity prices. The end of QE2 was made more significant with Greece, again, front and center. Then there was the repeated increase in margin requirements that forced significant selling in the silver market, which briefly spilled over to other commodities. After weathering a trifecta of investment challenges, one must consider where the market goes from here. Are these priced in or does Greece cause the euro to further devalue against the dollar? Has China finished raising interest rates and bank reserve requirements for now? Will interest rates move higher or even spike if the Fed does as they say, and end QE?

Lots of questions – I’ll attempt to answer the answerable and tell you what we are doing and what can be expected.

Lots of questions – I’ll attempt to answer the answerable and tell you what we are doing and what can be expected.

Sometimes there are events that cause short-term selling, or even, panics. When they are foreseeable, we prepare for them by reducing or eliminating some positions and adding to our cash so that we may take advantage of any opportunities which may result. That is what we have done in the past two months and we will likely sit on some extra cash until we can determine the effects of QE2’s end. Greece is of importance and they will likely default in some manner or another, on their government debt; sooner or later. If the EU decides to bail Greece out (again), effectively kicking the can down the road, the euro will likely strengthen against the dollar. If Greece is allowed some sort of negotiated default, the euro will likely fall against the dollar. Either event will likely be short-lived and either event will likely have little effect on the price of gold since there will be increased buying of gold by Europeans or Americans (depending on the declining currency). The other beneficiary, if it can be called that in this devaluation environment, would be the Swiss franc. I expect it is much more likely that the can will get kicked at least a few more times, so imminent default may be discussed many more times.

It is still the end of QE2 and its effect on the dollar carry trade that is of most immediate concern.

Since last fall when Mr. Bernanke set the course for QE2, buying some $75 Billion of U.S. Treasuries each month, hedge funds and investment banks have borrowed dollars at near 0% interest rates and then invested them around the world, often in emerging markets or in-betweeners like Australia, where they might earn 5% or more in interest or perhaps they bought silver or oil with their free dollars. For months I have given much thought to the end of QE2 and whether it would cause interest rates to spike and bring a flood of money back to our shores, causing commodities and the markets to drop in price. First thoughts were exactly that and I believe many investors who have just begun to give it some serious thought are thinking that today, so we have seen some market reaction recently, but much of the chaos was initiated by the afore mentioned trifecta.

Like the mortgages made in the fall of 2006 that were to reset in the fall of 2008, I’ve had many months to consider this as well. At this point, I firmly believe that most commodity prices will be significantly higher at the end of this year than they are now. Long-term interest rates will likely move higher while the Fed will keep short-term rates near zero. It is the near zero short-term rates that will allow the carry trade to unwind in a peaceful manner rather than the manner in which it unwound in late 2008. In ’08 it was not interest rates, but the mortgage-backed securities that caused a disorderly unwinding which resulted in half of the hedge funds in the world, going bankrupt and selling all their assets. Since the Fed can keep short-term rates low for a very long time, and the carry trade uses short-term money, I don’t see July resulting in anything significant, unless it surprises to the upside.

It is likely that much of the pullback in our space, is behind us, but since I don’t own a crystal ball, we have raised our cash position to over 25%, mostly held in foreign currencies. Though I am not expecting smooth sailing, I do believe we can continue to move forward and will have another good year. The long-term picture simply has not changed. Companies are very lean, they are growing their earnings abroad and due to strengthening currencies in the emerging markets, they are enjoying strengthening pricing power amid a devaluing dollar. The dollar, euro, yen and pound are all travelling down the same hole as illustrated by the charts below which illustrate the increasing number of dollars.

Measuring the Quantity of Dollars

Unprecedented Deposit Currency Creation by the Fed

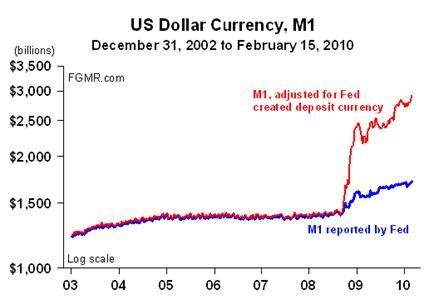

The Federal Reserve in the past has only created cash (printed) currency. However, the unprecedented changes it has engineered over the past two years have resulted in a vast amount of deposit (electronic) currency. Instead of purchasing paper from the banking system solely with cash currency – the Federal Reserve since the start of the financial crisis has increasingly relied upon deposit currency to purchase paper.

Regardless how the Federal Reserve pays for the paper it purchases – cash currency or deposit currency – it is creating dollars and expanding the money supply. But the traditional definition of M1 money supply does not accurately capture this process when the Fed uses deposit currency to pay for its purchase. In fact, it is totally excluded. Because the Federal Reserve did not create deposit currency in the past, none of the Ms (M1, M2, or the now discontinued M3) take it into account.

Consequently, the traditional definitions of the Ms are outdated because they do not capture the total quantity of dollars in circulation. Because M1 is underreported, so too is M2.

The following chart shows the quantity of demand and checkable deposits, i.e., the amount of deposit currency, at the Federal Reserve since December 2002. From December 2002 until the collapse of Lehman Brothers in September 2008, the quantity  of deposit currency created by the Fed averaged $11.8 billion, an amount that is relatively insignificant compared to total M1(money supply). Presently, it stands at a record high of $1,246.2 billion, which of course is highly significant. More to the point, none of this deposit currency is captured in the traditional definition of the Ms. The quantity of dollar currency is therefore significantly underreported, which is illustrated by the following chart.

of deposit currency created by the Fed averaged $11.8 billion, an amount that is relatively insignificant compared to total M1(money supply). Presently, it stands at a record high of $1,246.2 billion, which of course is highly significant. More to the point, none of this deposit currency is captured in the traditional definition of the Ms. The quantity of dollar currency is therefore significantly underreported, which is illustrated by the following chart.

The Federal Reserve reports M1 to be $1,937 billion as of May 2nd. When deposit currency created by the Federal Reserve is added to the traditional definition of M1, M1 after adjustment is actually 170% higher at $3,518 billion. Its annual growth increases to 29.5%, nearly 3-times the rate reported by the Fed.

This restatement of M1 explains why crude oil is back at $100 per barrel; copper is $4.05 per pound; and commodity prices in the main are rising in the face of weak economic conditions. The US dollar is being inflated and worryingly, the rate of new currency creation is approaching hyperinflationary levels. Unless the Federal Reserve changes course, the US may face a deposit currency hyperinflation like those that plagued much of Latin America in the 1980s and 1990s, along with Russia (1993-2004), Weimer Germany (1923), Hungary, China (’48-’49) Iceland (2008-’09), Yugoslavia, Belarus, and many others. I don’t expect U.S. hyperinflation, but considering gold was $35/oz. when we last backed our currency with gold – it must not be ignored. Consider the following:

Using the FED’s M1, gold would have to be $13,150/oz. if we were to return to a gold standard, assuming we actually have the reported 147.3M oz of gold (by U.S. Mint) . (1.716T reported M1 divided by 147.3M oz. of gold)

Adding deposit currency created by the Fed, gold would have to be $23,900.

To the contrary, China’s currency is Appreciating:

As I wrote in the March newsletter, China’s renminbi is appreciating and will likely continue for years. For the past nine months it has steadily appreciated about ½% per month, now up over 5% from the start. A strengthening currency is the best way for China to fight inflation and make its citizens richer. Combine the strengthening currency with rising incomes and it bodes well for companies selling goods and services to China and the Chinese. It is the one significant rotation that we have employed over the past eight months – that being from Chinese exporters to companies selling to the Chinese. It is still about China, but this rotation promises to be even more profitable, more predictable and longer lasting.

Though I don’t believe that either the end of QE2 or Greece will be the big problems that they were initially believed, I believe our raising cash will provide us an added measure of safety and perhaps allow us to take advantage of some buying opportunities over the next couple of months. Like I often say, “I’d rather lose opportunity than money”.

Looking forward to discussing the rotation within the energy sector, but that will have to wait.

祝你身体健康和盈利的投资 (May you enjoy good health and profitable investing),

Frank

Disclosure: Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Frank Beck & Beck Capital Management explicitly disclaims any responsibility for product suitability or suitability determinations related to individual investors. The investment products discussed herein are considered complex investment products. Such products contain unique risks, terms, conditions and fees specific to each offering. Depending upon the particular product, risks include, but are not limited to, issuer credit risk, liquidity risk, market risk, the performance of an underlying derivative financial instrument, formula or strategy. Return of principal is not guaranteed above FDIC insurance limits and is subject to the creditworthiness of the issuer. You should not purchase an investment product or make an investment recommendation to a customer until you have read the specific offering documentation and understand the specific investment terms and risks of such investment.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.