Q4 2022 Market View

This has been a challenging year for markets, to say the least. As of Sept. 30th, the S&P 500 index was down 24.77% year-to-date (YTD) and the Nasdaq was down 32.40%. This has marked the worst year for markets since the financial crisis and one of the worst three quarters on record. Bonds hardly proved a better place than equities this year either, with the S&P U.S. Aggregate Bond Index down 13.45%, and even the S&P Municipal Bond Index down 11.50%. While we aren’t going to call a low for the year, we believe we’ve witnessed most of the pain in this market and anticipate a better environment ahead.

In this issue, we’ll discuss:

- Federal Reserve and Rate Policy

- International Monetary Policy and Challenges to Hawkishness

- Employment Resilience in the U.S.

- Oil & Gas Markets

- Real Estate and REITs

- 6-month Treasury Purchase

Fed Wavering on its Policy Stance

Following the note we sent out recapping the September Federal Reserve rate policy decision, we’re seeing some of the themes we discussed, play out in the marketplace. Specifically, international pressure is mounting on the Fed and other central banks to cool their hawkish rhetoric and ease their rate policy positioning. While many Fed governors are reiterating their determination to bring inflation to 2%, others are noting warning signs that can’t be ignored.

UN Pressure on the Fed, Central Banks

On October 3rd, the United Nations Conference on Trade and Development (UNCTAD) warned of a global recession that could be triggered by the monetary policy agendas currently laid out by the world’s central banks. In their 70-page report, UNCTAD explicitly calls out rhetoric used by central banks like the Federal Reserve:

“…the attention of policymakers has become much too focused on dampening inflationary pressures through restrictive monetary policies, with the hope that central banks can pilot the economy to a soft landing, avoiding a full-blown recession. Not only is there a real danger that the policy remedy could prove worse than the economic disease, in terms of declining wages, employment and government revenues, but the road taken would reverse the pandemic pledges to build a more sustainable, resilient and inclusive world”

They are not trying to mince words here. As concerns like this grow, especially from globally recognized and accredited organizations, it will be increasingly difficult for the Fed and other central banks to blindly pursue their monetary policy agendas.

Global Hawkishness is Beginning to Abate

On 10/3, the Royal Bank of Australia, Australia’s Central Bank, decided to only hike their key lending rate by 25 basis points (bps) or 0.25%, instead of the 50bps anticipated by investors. While this is not yet indicative of broader central bank actions, we view it as a signal of a dovish inflection point in general sentiment. As more of the world’s central banks make rate decisions, we will confirm if this is a growing trend.

On the U.S. policy front, many Fed representatives remain extremely hawkish, but some are sounding cautious. Raphael Bostic, president of the Atlanta Fed, recently noted: “In my view, the Committee should not overreact if, as appears likely, inflation does not fairly quickly fall back into the 2 percent range, even if we see some slowing in economic activity.” Comments like these bode well for a sensible inflation debate.

As of 10/5, credit markets were pricing in 66 basis points of hikes by the Federal Reserve at their November meeting, signaling a 50/50 chance of the Fed raising their key rate by 50 or 75 bps. U.S. Treasury yields have fallen modestly from their most recent peak at the end of September, and the Federal Funds rate ceiling is now seen around 4.5%, falling below the 4.6% Fed “dot” target signaled at the September meeting.

The bottom line is markets are noticing the de-escalation of hawkish rhetoric and are pricing in this sentiment accordingly. We believe we may have seen peak Fed hawkishness already.

Good Jobs Numbers – A Bad Thing?

One data point holding up the Fed’s hawkish agenda is U.S. employment data. U.S. employment numbers and wage growth have stayed strong – something one would typically believe is a good sign. Not so much for the Federal Reserve this year. As we continue to see low unemployment figures and sustained wage growth, the Fed feels justified in its mission to hike rates and bring down inflation across the labor market. Unfortunately for those affected, the Fed isn’t afraid of inflicting pain on the economy that they deem necessary. When referring to inflicting pain to bring down the inflation rate in his September 21st FOMC address, Jerome Powell notes that he “wish[es] there were a painless way to do that, there isn’t.”

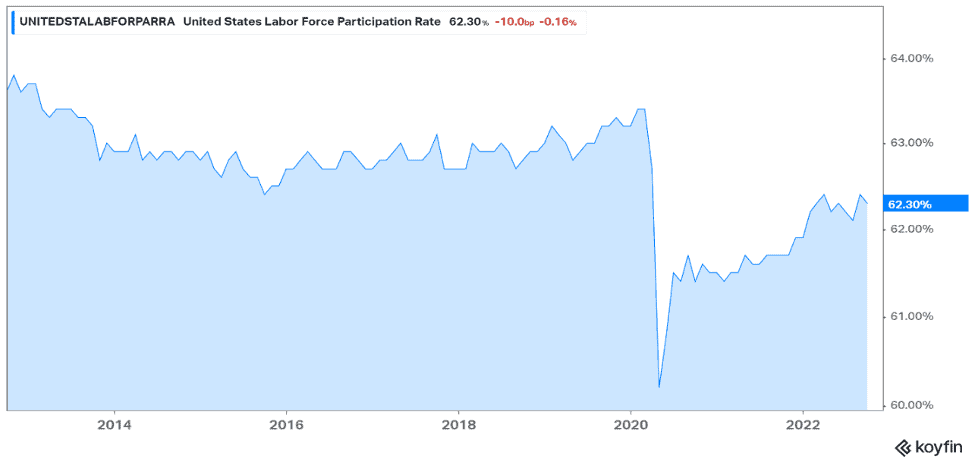

We would be quick to advise the Federal Reserve to reference the labor force participation rate – calculated as the labor force divided by the total working-age population. The participation rate has yet to return to pre-COVID levels and as of the 10/7 report remains 1.1% lower than it was in February 2020. Until labor participation recovers, we believe unemployment rates will be skewed to the downside.

Time will tell which narrative will win the day. Will it be international cries for easier monetary policy, or will the threat of inflation be too big to ignore? It’s too early to tell but seeing a debate between the two is a good sign for global markets.

The Broader Oil Story

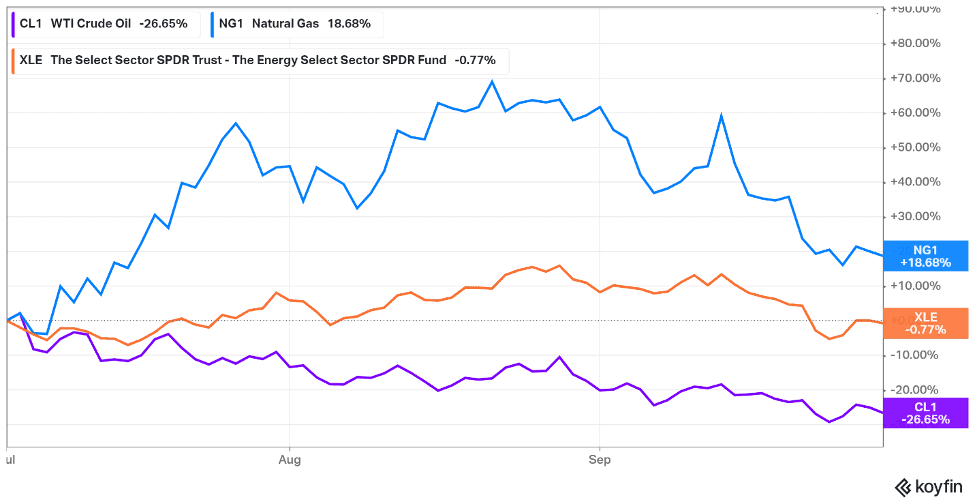

Energy markets have been on a roller-coaster ride this year, to say the least, but energy remains our highest conviction sector and the only sector in the green for the year. We believe insulated demand, lower production domestically and internationally, under-investment in fossil fuel infrastructure, and the halting of U.S. Strategic Petroleum Reserve depletion will continue to drive outperformance for the sector.

Over the course of the quarter, we witnessed natural gas climb from $5.70 to over $10 and back down to $6.77, WTI Crude Oil declined from $108 to $78.83, and XLE the Energy Select Sector SPDR Fund remained almost flat from $72.38 to $72.02.

Oil prices dipped over the quarter predominantly due to recession fears – traditionally recessionary periods result in a decrease in overall economic activity including goods shipments which results in lower oil demand. While the international economy may enter some form of recession, we believe demand-side fears are overblown. Supply chains are still working themselves out, inventories are still filling up, and job strength in the U.S. signals somewhat resilient demand for goods domestically.

Following recent developments in the Russia-Ukraine war, it is unlikely that Russia will contribute significantly to the global oil supply moving forward. As Putin escalates the war, he not only removes the West as a buyer of Russia’s oil but even India and China who enjoyed discounted Russian oil are likely to think twice about partnering following a potential nuclear escalation. Further, Europe has secured its place as a long-time consumer of U.S. energy with continued investment in Liquid Natural Gas (LNG) terminals and under-investment in their own energy production infrastructure. Now that the tap has been cut off to their East, the U.S. is their best option for energy supply going forward. Finally, the U.S. ends its depletion of the Strategic Petroleum Reserve in November, which has served as a consistent headwind to energy prices since the beginning of the Summer.

We have decided to take advantage of these changes in the energy marketplace by investing in upstream oil & gas producers, LNG terminal owners, and LNG shipment companies.

Real Estate and REITs

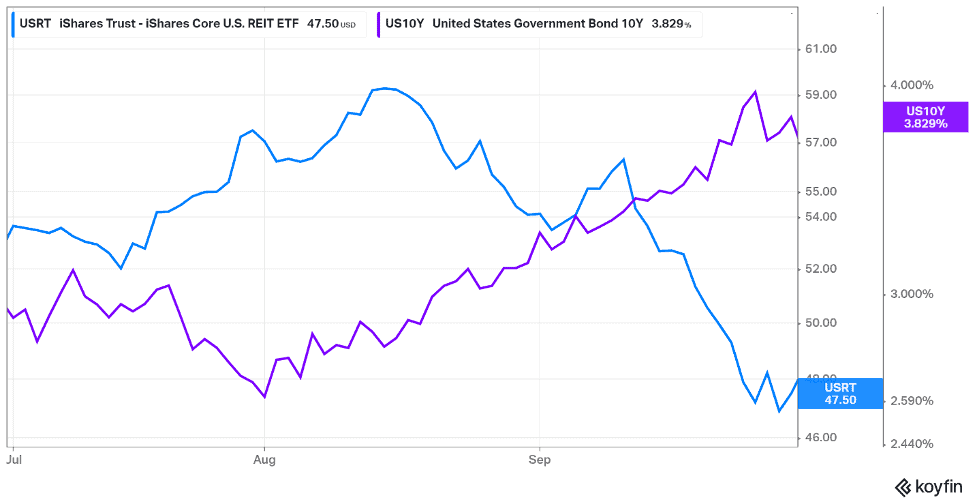

The U.S. Real Estate Investment Trust (REIT) market has experienced its own volatility as of late, primarily driven by yield shifts in U.S. treasury bonds. Many investors view REITs as a fixed-income or bond alternative considering they’re known for distributing 90% or more of their earnings in the form of regular dividends. This comparison weakens REIT demand when bond yields rise and has resulted in a moderate selloff over the last few months.

As mentioned previously, we may have reached peak Fed hawkishness, in which case future treasury yield movements are more likely to provide a tailwind for REITs than a headwind. In the meantime, we are happy to collect dividend yields in the mid-to-high single-digit and some double-digit ranges. The only question we must ask ourselves is are these dividends safe? That is why we have chosen to invest in REITs with properties in stable end markets and necessity-driven businesses. We fundamentally believe the portfolio companies we are invested in will continue to pay their rents and the dividends will follow. As for mortgage REITs (REITs that focus on credit markets rather than physical real estate), we have been sure to select companies with reasonable debt levels and cash flow forecasts that cover dividend payments well into the future.

6-Month Treasury

Due to the increase in government yields and our prospects for treasuries moving forward, we have also taken the opportunity to include 6-month U.S. treasuries in many of our portfolios. It has been many years since we’ve decided to buy bonds, but we find the yields compelling for a short time horizon. Allocating cash here for a yield of 4.088% will reduce volatility and provide a respectable return while markets continue to sort themselves in the near term. All Treasuries are guaranteed by the United States taxpayers, providing the highest degree of safety, and now, with a competitive yield. Should interest rates remain high or higher, we plan on maintaining the position to maturity. Should the market improve and the rates drop, our intention is to sell the Treasuries, hopefully at a slight gain, and deploy the money into what we believe at the time, to be our best options for growth.

Conclusion

It has been a challenging year thus far, but we believe we are close to the end of this painful market cycle. With Fed rhetoric improving and what we believe may be the peak in interest rates, we are beginning to see the clouds parting ahead. We remain wary of the economic environment we are in, but believe we are well-positioned in our current portfolio.

RISKS & DISCLOSURES

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The S&P U.S. Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. The index is part of the S&P AggregateTM Bond Index family and includes U.S. treasuries, quasi-governments, corporates, taxable municipal bonds, foreign agency, supranational, federal agency, and non-U.S. debentures, covered bonds, and residential mortgage pass-throughs.

The S&P Municipal Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. municipal bond market.

Index results are shown for illustrative purposes and do not represent the performance of any specific investment. Indices are unmanaged and investors cannot directly invest in them. They do not reflect any management, custody, transaction or other expenses, and generally assume reinvestment of dividends, income and capital gains.

There are risks associated with fixed income investments, including credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities. Past performance is not a guarantee of future results.

A REIT is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate. There are risks associated with these types of investments and include but are not limited to the following: Typically no secondary market exists for the security listed above. Potential difficulty discerning between routine interest payments and principal repayment. Redemption price of a REIT may be worth more or less than the original price paid. Value of the shares in the trust will fluctuate with the portfolio of underlying real estate. There is no guarantee you will receive any income. Involves risks such as refinancing in the real estate industry, interest rates, availability of mortgage funds, operating expenses, cost of insurance, lease terminations, potential economic and regulatory changes. This is neither an offer to sell nor a solicitation or an offer to buy the securities described herein. The offering is made only by the Prospectus.