Snapshot – Today thru 2013

1) Macro Picture

We believe market direction will continue to depend on the evolution of three key macro risks: 1) European sovereign risk, 2) China growth, and 3) US growth. Additionally, the well-worn bi-modal risk of politics and austerity have elevated risk aversion and compelled investors to react to news rather than invest according to outlook and fundamentals

2) US Growth

A run of dispiriting economic data confirms our view that the US economy is growing, but at a lackluster pace of 1.5%-2.0%. While the private sector is gradually healing, the process is inherently slow and subject to reversal.

3) Employment

We expect a slight drift lower in the unemployment rate, despite moderate GDP growth. The reason being that the high level of long-term unemployment may lead to lower labor force participation rates as workers lose skills, develop a stigma in the eyes of employers, or simply become discouraged about job market prospects. We expect the unemployment rate to end 2012 at 8.2% and depending on election outcomes to remain in the 7% to 9% range next year. With a Romney victory, we expect a repeal of the Health-care act and a lower tax burden, allowing corporations to fulfill a pent-up demand for new hires that have been resisted due to these two unknown costs. The number of hours worked per employee has been steadily increasing this year, indicating a need for more employees. Eliminating the two burdens would likely result in 3 Million jobs created next year, resulting in higher tax revenues without the higher rates.

4) Inflation

Under an Obama victory, excess capacity, absent labor cost pressures, and falling commodity prices should slow inflation further. Headline CPI could fall below 1.0% by the end of the summer and core inflation may moderate to 1½% in 2013. With a Romney victory, we expect slightly higher inflationary pressures due to more income chasing the goods available.

5) Federal Reserve Policy

Should the economy perform as we expect, the Fed is likely to ease further. We believe the sequence of policy responses will be as follows: 1) move forward guidance at the next FOMC meeting from “late 2014“ to “mid-2015” or perhaps the Fed might quit giving end dates and use the term “as needed”, 2) complete Twist 2 in late 2012/early 2013, and 3) execute another asset purchase program that involves both balance sheet expansion and MBS purchases (QE3). Under a Romney administration, the Fed may be subdued and certainly come February 2014, we expect Bernanke would be replaced.

6) Housing

The housing sector has become a ray of light. Home sales and building activity have trended higher while house prices have surprised on the upside. Numbers suggest that the bottom in nominal home prices is now behind us, though massive excess supply in some parts of the country should keep the housing recovery “U-shaped” rather than a “V”.

7) S&P 500

Policy on both sides of the Atlantic continues to dominate markets and frame our guarded year-end target of 1450 on EPS of $100. Longer-term, we consider equity opportunities to be the most compelling in a generation due to unsustainably high risk premia, low to moderate valuation, and an overly pessimistic view of long-term growth expectations. Recovery may not be imminent, but is in the offing.

8) Interest Rates and Credit

We expect the 10-year Treasury to end 2012 at 2.0% as: 1) we anticipate some improvement in growth expectations supported by global policy easing, and 2) less anxiety around Europe’s viability as policymakers slowly make more convincing progress, causing safe-haven money to flow out of the U.S.

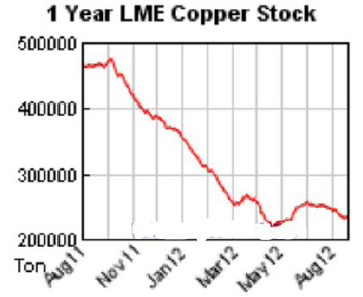

9) Commodities

Macro pressure and financial deleveraging have pulled price levels below those justified by fundamentals. In crude oil, our long-standing view of limited OPEC spare capacity and disappointing non-OPEC supply remains intact. On the latter, rising US oil supply from new US “shale” plays appears to be offset by supply disappointments in Iran, Iraq, the North Sea, Brazil, and geo-political turmoil in Sudan and Syria. More broadly, we also favor copper, aluminum, and gold. (see London copper stock chart below)

10) Currency

The USD trade-weighted index has appreciated due to Euro area tension and “safe haven” flows. However, our core view over the medium and longer term is to expect broad Dollar weakness due to large structural deficits and the relative monetary stance of the US Fed.

Commentary:

This is certainly going to be an interesting week. It is the kind of drama that makes me think, “I should wait until Saturday to write this letter”. Unfortunately, that has been the case for two years now – the Fed, the ECB, the White House, Greece and many other spendthrifts continue to dominate the markets and fundamental issues remain a small current in a raging river.

It is easier to talk about Europe’s problems so I will start with them. For years we have seen most of Europe over-promise and overspend, accumulating insurmountable debt that has brought their economies to a slow grind and more recently, to a halt. Until Mario Draghi took the reins as President of the ECB, has there been a real attempt to do more than just “kick the can down the road”. Draghi is an Italian and Italy, along with Spain, is the real line in the sand (Greece has become a footnote and may stay or go). Prior to Draghi, France’s Jean-Claude Trichet headed the ECB and was not so concerned about the plight of France which seemed much less vulnerable, so kicking the can was a somewhat low-cost way of buying time while hoping for a dream or prayer to fix the problems. Unfortunately for Europe, investors seldom ignore the obvious.

However, Mario Draghi has suggested his own version of QE, but his has a caveat. In order for the ECB to purchase the bonds of a member country, the country must first ask for the aid and in doing so, must agree to “strict” austerity measures. Not a bad idea for our Fed to implement – a little restriction on deficit spending before printing more dollars?

Ordinarily I would declare such a plan to be inflationary thru the devaluation of the currency, but in this global environment where every major nation is doing the same, it will likely allow these indebted countries a chance to right their ships if they choose to do so. Got Gold?

Back in the U.S.

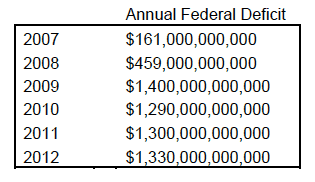

The Fed will come out of their Jackson Hole this week and the tone and innuendo of Ben Bernanke will be read to mean, more – or no more – magic money here. It was interesting to see the St. Louis Fed, James Bullard, recently suggest that he may support negative interest rates on bank reserves, rather than QE3. Combined with an incentive for making “good” loans, the banks might replace “free QE money” with the incentives for stimulating the economy. Personally, I believe both to be bad ideas as the last time D.C. encouraged banks to make loans they constructed the 2006 housing bubble. A better Fed action might be, say to Washington that no more QE is coming as it is time to end the ridiculous spending that has taken place over the last ten years. The last six deficits are easily attainable and listed below:

In just eight years, George Walker Bush matched the debt of the first 42 Presidents and in just four years Barack Hussein Obama has matched the debt of W. At this pace we will have a federally funded debt of over $20 Trillion in just three more years – we will be a bankrupt nation with little hope of monetary salvation. No country, not Greece, and not the United States is immune to the basic principles of finance – the dollar will collapse. This ignores our unfunded debt of Social Security, Medicare, Medicaid, the Prescription Drug bill, and government pensions, which add approximately $80 Trillion to our tab. Of course the government can default or just partially pay all of these in the future as no one really wants to talk about fixing them today. Sad thing is that these can with relatively little pain, be fixed if only our D’s and R’s would decide to do so – but then it is election season (again).

Good News: We have devised an investment strategy for an Obama victory, and one for a Romney victory. Each Tuesday, our investment committee continues to discuss the fiscal and monetary ramifications of each outcome so we are prepared on November 7th.

Currently, we have a high dividend portfolio, based on companies selling at attractive valuations, consistent and growing earnings, and relatively little volatility relative to the S&P 500. It is a portfolio that is somewhat easier to sleep with at night as it tends to lose less on bad days, make more on marginal days, but slightly underperform the market on great days. We continue to replace companies that fall out or grow out of these parameters and replace them with others that meet the criteria. Sometimes that means selling an Amazon because it grows to a very rich valuation – one that I can live with in a growth economy, but one that can drop 20% in a day on bad news. I still view it as one of the best companies on earth, but simply too rich to own today.

Today we have what I call a rowing economy – we reduce risk and row into the current to make money; versus a sailing economy where the wind is at our back and we can throw open the sails. I expect the current portfolio will do well with either outcome in November and we will simply make a few changes to accommodate our outlook.

Disclosure: Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Frank Beck & Beck Capital Management explicitly disclaims any responsibility for product suitability or suitability determinations related to individual investors. The investment products discussed herein are considered complex investment products. Such products contain unique risks, terms, conditions and fees specific to each offering. Depending upon the particular product, risks include, but are not limited to, issuer credit risk, liquidity risk, market risk, the performance of an underlying derivative financial instrument, formula or strategy. Return of principal is not guaranteed above FDIC insurance limits and is subject to the creditworthiness of the issuer. You should not purchase an investment product or make an investment recommendation to a customer until you have read the specific offering documentation and understand the specific investment terms and risks of such investment.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.