2nd Quarter Outlook, 2018

Bull Market “long-in-the-tooth”?

As we begin this 2nd quarter of the year, we have seen a strong January as Q4 earnings came in very strong, combined with optimism from the Tax Reform Bill. January was followed by a volatile February & March, leaving many investors nervous and too often focusing on the problem du jour and forgetting the economic backdrop. Fortunately, we are now entering Q1 earnings reports and we expect they will be stronger than expected due to the lower corporate tax rates which have not been fully factored in to estimates.

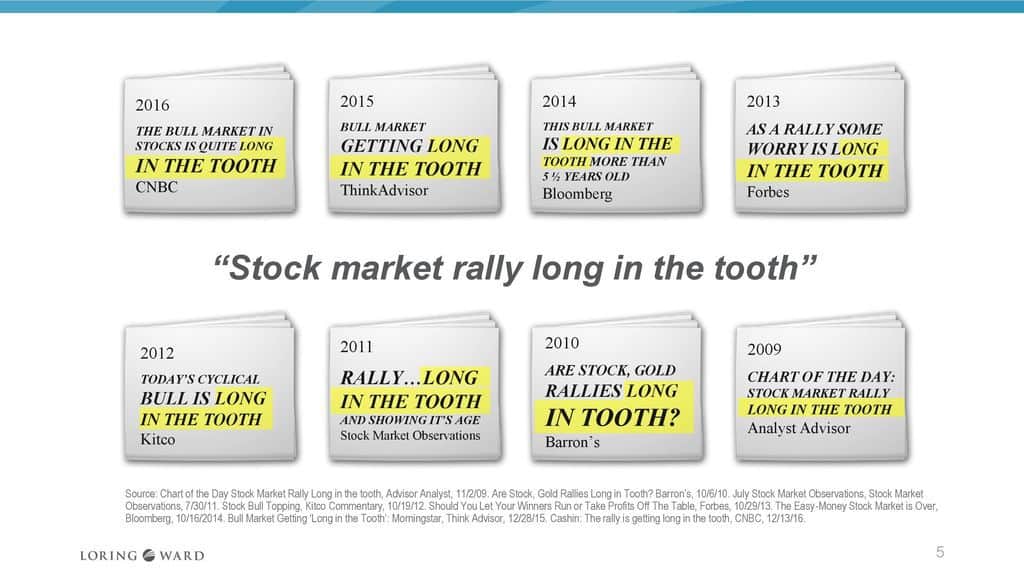

It is likely that you’ve heard (probably many times) that the bull-market is old – one of the oldest in history. 1st, bull markets don’t die of old age and 2nd, this one has been hampered by over-regulation and anti-business sentiment for much of its life.

As you can see from the charts above, this recovery has taken much longer and still has not reached the levels of past recoveries. And 3rd, I would argue that the bull market coming out of the recession, actually ended in early 2015 and a new bull market began in November of 2017. During that nearly two-year period the stock market went sideways with no gain. At some point a sideways bull market should be considered to have ended, but the strict definition declares it ends when it has a closing price 20% below the previous high. There is no number of months of zero gain in the definition, but if 20 months is not long enough, would 20 years have been sufficient? Additionally, in 2012, there was a 20% drop, but it was intraday and closed only 19.8% below, so the bull survived. The point is, measuring the length of a bull market using an arbitrary definition offers no insight as to its end.

Earnings

Since late January, the markets have been more volatile than most times, especially considering the lack of volatility of the previous 14 months. With the volatility, many investors sold at depressed prices and were replaced by new investors who were forward looking rather than focusing on the distraction of the day. That setup this earnings season, which is just now getting under way, to be one in which good earnings reports should reignite a strong market.

As a backdrop, estimates are expecting the S&P 500 to increase earnings this year by 15% to 20%. Since profits ultimately drive stock prices, it is unlikely that this portends a bear market or a big decline. It more than likely will result in an extension of the new bull market and lead to favorable returns. As can be seen in the chart below, the S&P 500 has followed earnings closely for the past two years, until the last couple of months. I expect the earnings line to continue moving higher and the S&P to regain its tracking.

The Fed & Market Valuation

With a new Fed President Powell, the market got jittery over the possibility that The Fed might raise the Fed Funds Rate faster than past President Yellen might have directed. Of course, higher interest rates impact the value of future earnings, but we are at such low rates relative to current earnings and especially relative to 2018 & 2019 estimated earnings, it is unlikely they will rise to the extent that they become a problem in the next year or more.

Using a capitalized profits model, we find the market to be significantly undervalued. The model uses current (not forecasted) earnings discounted by the 10-year Treasury yield to determine fair value.

At the end of 2017, the model shows the S&P to be approximately 25% to 30% undervalued. We do not expect the Fed raising interest rates three or even more times this year (unlikely in itself) will derail the economy or the market. If the earnings estimates are too rich and they only come in at 10%, that is additional value to be added to the already undervalued market.

The red dot on the graph shows where the model would be if the 10-year Treasury was yielding 3.5%. It closed today at 2.83% and is unlikely in this global market to reach that for a long time. The German 10-year is currently at 0.51%, so our higher rates bring overseas money, pushing our rates lower again.

Finally, the corporate tax cuts and the repatriation money will be used for many things. Certainly, some will go to higher dividends and stock buybacks, both of which are good for investors, but a large share will go to capital expenditures. Specifically, we believe, with the tighter employment market, robotics and other uses of semiconductors and software will be a focus for companies trying to become more productive. For that reason, we have been spending a lot of time and effort finding companies that will benefit from these purchases.

Companies selling productivity tools will be the first to benefit and companies implementing them will reap rewards later. After they’ve made the investment to buy and implement (those costs are behind them), we will want to identify and own many of them for 2019 and forward.

Becoming more productive now, could possibly have additional benefits in the future. There is a real possibility of expanding our workforce. Labor force participation is too low. Labor force participation in the United States has gone from 66% to 63% between 2008 and today. An aging population explains some of that, but if you examine the data more closely and focus just on labor force participation for one key segment; i.e., men ages 25-54, you’ll see that we have a serious problem. The chart below shows that in America, the participation rate for that group has dropped from 96% in 1968 to about 88% today. This is way below labor force participation in almost every other developed nation (see chart below).

If the work participation rate for this group went back to just 93% – the current average for the other developed nations – approximately 10 million more people would be working in the United States (an addition of 6.5% to the working). Opioid addiction has become a big problem in this group, but much larger is the use of social security disability – fifty-seven percent of these non-working males are on disability. It has become much too easy to qualify with unmeasurable afflictions, hurting both these young men and the social security system itself. The recently signed work requirement for welfare and stricter definitions for disability, along with a more vibrant economy, might save some of these young men (and women too) while helping shore up the welfare and social security systems – with the added benefit of a larger workforce and more happy consumers.

Trade & Tariffs

There is a lot of hyperventilating about trade and tariffs recently. On the one hand we have those who believe trade deficits will harm us and are unsustainable. And on the other side we saw investors running for the hills at the mere mention of possible tariffs. Personally, I run a trade deficit with Jack Allen’s and Eddie V’s restaurants. I doubt it will ever be close to equal as for the past few years it has been completely one-sided. Yet, (other than a few extra pounds) it has had zero harm to my family.

Trade needs to be fair, but it does not need to be equal. It is not fair to steal technology or flood other countries with goods at less than cost, with the result being the loss of an entire industry for one country. We saw this with rare-earth elements. Rare-earth metals are needed in much of our technology, whether it be an iPhone or a Tomahawk missile, electro magnets, plasma screens, etc. For years China subsidized the flooding of the world with these and every rare-earth miner in the United States (and most other countries) ceased to exist.

The “fair” has to do with similar or equivalent products, especially those with a national security effect.

So fair trade is necessary, but even if another country does not practice free trade on different products, it does that country’s citizens the harm. Let’s say China were to invent a cure for cancer and the U.S. invented one for heart disease. If China put a 100% tariff on our cure, would we be better off by imposing a similar tariff on their cancer cure? Where it concerns products not made in the USA, the trade deficit, no matter how large, has no more negative effect than my family’s restaurant deficit.

Since most of this attention has to do with China and most in the press talk as if China holds all the cards – will they quit buying our debt and will we be cut-off from the world’s largest market? I want to point out why China wants a trade war less than we. China owns our debt because it makes their currency more acceptable – not as a favor to the U.S. Last year China exported over $500B to the U.S. while only importing $130B. That gives our lawmakers four times the leverage. China needs our trade as they desire a place as a top military power. Any significant trade problems would be uncomfortable for us, but devastating for them, including a possible expulsion of their ruling class. A China trade-war should and will be avoided – my point – it is overblown in the stock market. Neither our leaders or theirs want that – the most likely result, which President Xi acknowledged recently, is China will begin to respect patents and trade secrets to some extent more than they have previously. This will be good for our economy/companies/markets.

America – A great place to live and invest

America today is probably stronger than ever before. For example: • The United States has the world’s strongest military, and this will be the case for decades. We are fortunate to be at peace with our neighbors and to have the protection of the Atlantic and Pacific oceans. • As a nation, we have essentially all the food, water and energy we need. • The United States has among the world’s best universities and hospitals. • The United States has a generally reliable rule of law and low corruption. • The government of the United States is the world’s longest surviving democracy, which has been steadfast, resilient and enduring through some very difficult times. • The people of the United States have a great work ethic and can-do attitude. • Americans are among the most entrepreneurial and innovative people in the world – from those who work on the factory floors to geniuses like the late Steve Jobs. Improving “things” and increasing productivity are American pastimes. And America still fosters an entrepreneurial culture, which allows risk taking – and acknowledges that it can result in success or failure. • The United States is home to many of the best, most vibrant businesses on the planet – from small and midsized companies to large, global multinationals. • The United States has the widest, deepest, most transparent and best financial markets in the world. And I’m not talking about just Wall Street and banks – I include the whole mosaic: venture capital, private equity, asset managers, individual and corporate investors, and public and private capital markets. Our financial markets have been an essential part of the great American business machine. Very few countries, if any, are as blessed as we are.

Jamie Dimon, CEO of JP Morgan Chase (a Democrat) on a competitive tax system & why both sides of the political aisle should work together to solve problems:

“It isn’t easy to stay competitive in an increasingly global marketplace, and national tax policy was one critical area where we were falling behind. Over the last 20 years, as the world reduced its tax rates, America did not. Our previous tax code was increasingly uncompetitive, overly complex, and loaded with special interest provisions that created winners and losers. This was driving down capital investment, reducing productivity and causing wages to remain stagnant.

The good news is that the recent changes in the U.S. tax system have many of the key ingredients to fuel economic expansion: a business tax rate that will make the U.S. competitive around the world; provisions to free U.S. companies to bring back profits earned overseas; and, importantly, tax relief for the lower income and middle class. The passage of tax reform was critical because strong businesses create jobs and higher wages. Before tax reform was passed, 76% of the CEOs of leading U.S. companies said they would increase hiring if tax reform were enacted, and 82% would increase capital spending – and we already are seeing these effects. Hundreds of companies like ours are stepping up by investing in their employees and in initiatives to address challenges facing communities. I must confess I don’t understand how anyone could believe an uncompetitive tax system would be good for the United States – whether the current economic environment was good or bad. The damage has been cumulative.

Here is one example: A recent study by the accounting firm Ernst & Young (EY) found that under a 20% corporate income tax rate, U.S. companies would have acquired $1.2 trillion in cross-border assets during 2004-2016 instead of losing $510 billion in such assets to foreign buyers. Simply put, this means the United States would have kept 4,700 companies under U.S. ownership during the past 13 years if they had paid taxes at a rate competitive with other countries that have modernized their corporate tax codes. Today’s competitive U.S. corporate tax rate will reduce incentives for U.S. companies to relocate abroad or be purchased by foreign companies. There is a reason why it has taken 30 years for comprehensive tax reform to take place in this country: It is complicated work, and navigating competing interests is hard. I am pleased that we did the right thing – not the easy thing.

Congress took a historic step in 2017 to reform America’s broken and outdated tax code. Coming together to get that work done shows that we can take on tough issues that have been holding us back. I believe tax reform will have both short and long-term benefits. In the short term, we already are seeing some companies increasing capital expenditures, hiring and raising wages. Some argue that the added cash flow going to dividends and buybacks is a negative – it is not. It simply represents capital finding a higher and better use than the current owner has with it. And that higher and better use will be reinvestment in companies, innovation, R&D or consumption. Thinking this is a bad thing is just wrong. Tax reform’s real benefit will be the long-term cumulative effect of retained and reinvested capital in the United States, which means more companies, innovation and employment will stay in this country. The United States should always aim to have a competitive business tax system. It should not be traded off against other objectives”.

We at Beck Capital Management hope you have a wonderful spring and year; may many blessings be yours.

Sincerely,

The Beck Capital Management Team

April 2018

https://www.facebook.com/BeckCapitalManagement/

Please feel free to forward this to friends who you believe might be interested. To make sure you don’t miss our urgent updates, add Sandy@BeckCapitalManagement.com to your address book. If you have received this from a friend and would like to receive the next six issues at no cost or obligation, please send an email to Sandy@BeckCapitalManagement.com

All rights reserved by Beck Capital Management LLC.

If you would like to receive a copy of our Privacy Policy or Form ADV, Part II brochure, please let us know and we will be happy to provide it to you.

Investment advisory services offered through Beck Capital Management LLC, a registered investment adviser.This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Beck Capital Management explicitly disclaims any fiduciary responsibility or any responsibility for product suitability or suitability determinations related to individual investors, as may relate to the information contained herein.

Disclosure: Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Frank Beck & Beck Capital Management explicitly disclaims any responsibility for product suitability or suitability determinations related to individual investors. The investment products discussed herein are considered complex investment products. Such products contain unique risks, terms, conditions and fees specific to each offering. Depending upon the particular product, risks include, but are not limited to, issuer credit risk, liquidity risk, market risk, the performance of an underlying derivative financial instrument, formula or strategy. Return of principal is not guaranteed above FDIC insurance limits and is subject to the creditworthiness of the issuer. You should not purchase an investment product or make an investment recommendation to a customer until you have read the specific offering documentation and understand the specific investment terms and risks of such investment.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.