2022 – Year in Review

2022 was a challenging year for markets, to say the least. As of market close on December 30th, the S&P 500 index closed at 3,840 to finish the year down 18.1%. This marked just the 12th time that the S&P 500 index has finished down double digits and the 7th worst return over a calendar year. The Nasdaq was pummeled even more and closed at 10,466 to finish the year down 32.5%. Even traditionally safe bonds were nowhere to hide; most aggregate bond indexes were down double digits.

While the year was certainly painful, it provided some valuable lessons for investing:

- When money was cheap, high-valuation stocks and assets were your friends

Cryptocurrencies, high Price/Earnings (and many unprofitable) growth equities, and junk debt all experienced attractive returns in the post-Covid, easy money era

- As monetary policy tightened, profitable companies provided refuge

Cash flow and positive earnings can be key in tough times. These companies outperformed the broad market in 20221

- Sector allocation is important when times are tough

The only positive sectors for 2022 were Energy, Utilities, and Staples. High valuation sectors like Consumer Discretionary and Technology were the biggest losers

Our 2023 Outlook

Now that 2022 has officially closed, we can all look forward to a much better year for markets…right? As much as we would love to promise a soaring stock market over the next year, it’s likely to see somewhat muted returns, albeit we believe they will be positive. The continuation of heightened volatility is likely given the data-dependent nature of current market fluctuations. As the Federal Reserve (Fed) reiterates its resolve to slow inflation, the economy will likely enter some form of recession. However, in contrast to some of our peers, we believe this recession will be light and short-lived. Growing signs in the market are pointing to positive times ahead, and we believe there is much more to be encouraged about over the next year.

A Meaningful Turn in Economic Data

Economic data drove markets more than anything in 2022, so it’s positive that we’re seeing a meaningful turn in the data that drove headwinds to markets last year. As these macro-drivers turn, they’ll begin providing tailwinds and support for equities, rather than the contrary. Accelerating inflation has now begun to cool, a hawkish Fed is reaching peak interest rates, China’s zero-tolerance Covid policy has shifted 180 degrees, and we are seeing an improving environment for corporate earnings.

Disinflation in the Market

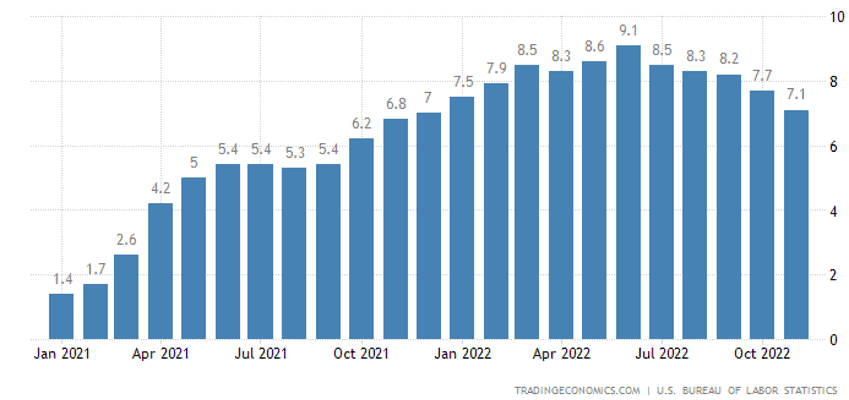

Following an inflation peak in June, we have seen a sustained downshift in monthly inflation prints, which bodes well for the future of monetary policy if we are to listen to the Fed. The Fed has remained resolute in its plan to reduce inflation to its 2% target, so all eyes are on the monthly inflation prints at this point. If the U.S. inflation rate continues its downtrend as we believe it will, the Fed will not have to create as much “pain” in the economy as it may have thought.

U.S. Inflation Rate % (YoY)

Thus far, employment data has remained upbeat even while inflation has cooled over the last few months. Wage inflation has existed, but it is far from the primary driver of ongoing inflation data. In fact, as we’ve mentioned before, we see resilient employment as a positive for the economy. If unemployment can remain depressed as inflation continues to fall, we are likely to see a muted negative economic impact from the Fed’s hiking cycle.

Signs of disinflation continue to point to lower Consumer Price Index (CPI) increases in the coming months. Commodity prices that drive goods costs have moderated now that supply chains are easing following their pandemic era chaos. More modest energy and food prices have also contributed to lower headline inflation figures. The largest contributor to inflation, shelter prices, is showing signs of weakness, and we believe will lead the way for lower inflation prints over this year. Lower inflation means a less hawkish Fed, and a less hawkish Fed means brighter market days ahead.

Corporate Resilience

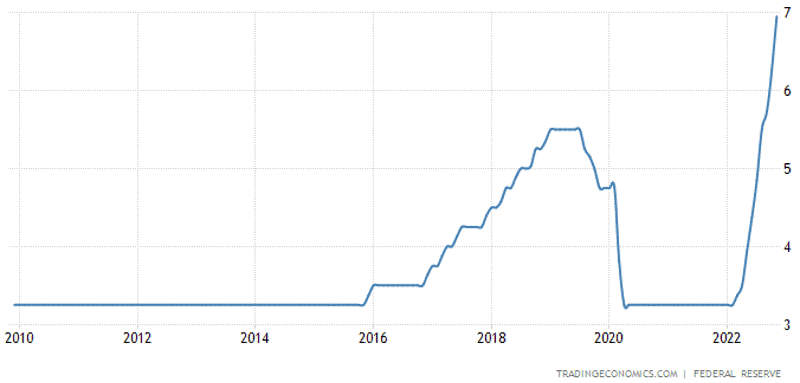

Another positive sign we see for markets is the demonstration of fiscal discipline by major corporations for the first time in several years. Since the Global Financial Crisis, the average U.S. prime lending rate has remained relatively low, leading companies to take on higher debt levels, using the cash to hire more workers, invest in new projects, and expand their operations. After all, if the money is almost free, why wouldn’t a company take advantage of it? After the Fed’s recent escalation of interest rates, borrowing rates are no longer near zero and corporations must take a hard-nosed look at their internal financials.

U.S. Average Monthly Prime Lending Rate %

Some of the jobs created in the era of easy money were not really that necessary and some projects no longer make economic sense at higher interest rates. Higher rates are driving the necessity for cost-cutting initiatives and a stronger corporate balance sheet. FedEx for example, reported quarterly earnings on December 20th, and while its revenue missed expectations by -3.86%, earnings surprised to the upside by almost +13% due to aggressive cost-cutting initiatives. Higher borrowing rates may present a near-term headwind for some companies, but we believe it will result in a more stable foundation for corporations in years to come.

Sector Outlooks

As we mentioned in our last letter, markets are likely to remain volatile over 2023, which is why we believe sector and equity allocation are critical. We believe some sectors will outperform others and have concentrated our holdings in high-conviction sectors while maintaining diversification.

Continued Confidence in Energy Markets

Energy remains our preferred sector for 2023. We conducted a deep dive on our bullish case for oil and natural gas in our November 2022 Energy Outlook. We remain convicted in the outlook for the Energy sector. Since our last update, the macroeconomic picture has turned for the better with China’s reopening and dropping of its zero-Covid policy. In fact, China’s stance has almost completely reversed, and they have even encouraged workers with mild Covid cases to return to their jobs. As the second largest energy-consuming country, China’s return to economic expansion should drive oil demand and should help support prices over the next year.

Natural gas should remain similarly supported by ongoing demand. Liquified Natural Gas (LNG) terminals continue to be built throughout the world, giving U.S. producers markets beyond what’s accessible via pipelines in North America. Following energy shortages in 2022, countries are increasingly declaring natural gas a “clean energy” and allowing more of its use for electricity production under Environmental Social and Governance (ESG) and climate regulations.

Despite soaring prices in 2022, neither oil nor gas production saw substantial investment. Firms are content generating the cash flow they are seeing amid today’s federal government energy policy. With growing demand and stable supply, we expect strong support for energy prices and companies in 2023.

Rotating into Financials

The Financials sector is one we’ve had little exposure to over the last few years. Low interest rates meant thin margins for banks and muted returns for shareholders. Following the Fed’s hiking cycle, we see brighter possibilities in consumer-focused banks. Lending rates have increased, leading to greater margins for creditors. We expect higher interest rates to lead to somewhat higher default rates in riskier debt categories, but for the increase in income to overwhelm what is lost to default. As we mentioned, the job market and consumers have been resilient, so there is not yet cause to worry about the banking system.

We are focusing on regional banks and banks that focus on consumer and small to medium-sized business lending. These banks tend to know their customer balance sheets better and are less impacted by investment banking deal flow compared to their larger peers.

Industrials and Materials to Ride China’s Reopening

We expect the Industrials and Materials sectors to perform well in 2023. Pockets within both groups are likely to benefit from the rapid China reopening and tailwind of global infrastructure investment. The re-shoring of supply chains amid the rise of growing geopolitical tensions means countries will have to invest in production capabilities domestically. To onshore these supply chains great capital expenditure is necessary, and those funds should flow to key industrial and materials companies. These two groups were also held back by a strong U.S. dollar over the last year. As dollar strength begins to decline, we expect these companies to benefit from greater international spending as affordability for foreign countries improves.

Maintaining Patience in Technology and Consumer Discretionary

Technology and Consumer Discretionary were the darlings of the Covid-era easy money environment, returning 91.47% and 67.70%, respectively, over the two-year period from January 1st, 2020 to December 31st, 2021. Those two sank dramatically over 2022 with Technology dropping 29% and Cons. Discretionary dropping 38.6%.2 We believe the valuations on companies in these sectors are coming into a much more realistic range and are likely to see attractive entry points along the way in 2023. Many of the companies in these sectors have attractive business models and positive growth outlooks, but they became overvalued in the years prior to 2022. As these companies enter what we believe to be strong fundamental levels, we plan to expand our exposure and take part in the growth resurgence following the economic downturn they are likely to experience this year. We believe cash flow and profitability are king in this higher-rate environment, so we intend to be diligent with our investments in these sectors, targeting companies with growing cash flows and positive earnings outlooks.

Pursuing Opportunities in Volatility

The volatility in the market was tedious in 2022, and unfortunately, it looks like 2023 will start the same way 2022 ended. Instead of dreading this volatility, however, we seek ways to make volatility our friend through using customized debt securities/notes and derivative products. Heightened volatility in the market, combined with higher interest rates, has led to what we believe is attractive pricing on these assets and we find them as attractive ways to take advantage of a tumultuous market environment.

2023 – A Year for Yield

Riding the rise in interest rates from 2022, we expect 2023 to be a great year for coupon-generating and high-dividend assets. Fixed income and fixed-income-like assets saw price declines as the Fed hiked rates over 2022 but are likely to have a much better year in 2023. Even in our most aggressive accounts, we hold many high-dividend paying assets such as Real Estate Investment Trusts (REITs), preferred shares, and high-dividend equities. We believe these assets have become oversold and demonstrate very favorable risk vs. return characteristics. Investment-grade corporate bonds and some parts of the treasury market have similarly entered attractive territory for us, and we believe we will hold and add to these positions over the coming year. In recent history, reaching out on the risk spectrum was required to earn substantial fixed income returns, but now we believe there are plenty of income-generating options across the market that may offer upside in addition to a dividend or coupon. We see these as a growing portion of our portfolio over the next year and an opportunity worthy of investment.

Conclusion

We expect 2023 to be a much better year than 2022. That’s an extremely low bar to hurdle, but we’re sure everyone would enjoy a green market to whichever degree, after last year.

Our key takeaways for 2023:

- Sector allocation will continue to be important

- Corporate balance sheets will exit the year much stronger

- Disinflation will continue, leading to favorable data for the Fed and a peak in the Fed Funds rate

- Energy, Industrials, and Materials will have strong years largely aided by China’s reopening

- Interest-rate-tied investments such as Financials, REITs, Preferred Shares, and Bonds will have a good year

- Volatility will remain high and certain derivative investments should benefit

The Federal Reserve and inflation data will likely continue driving the majority of market fluctuations this year, but by year-end, we believe we will be in a much more stable environment – both for the economy and for markets. Cheers to a new year and better days to come!

Risks and Disclosures:

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions.

Past performance is no guarantee of future results. Investing in the stock market involves gains and losses and may not be suitable for all investors.

This document may contain forward-looking statements based on (FirmName)’ expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. [FirmName] explicitly disclaims any responsibility for product suitability or suitability determinations related to individual investors.

The investment products discussed herein may be considered complex investment products. Such products contain unique risks, terms, conditions and fees specific to each offering. Depending upon the particular product, risks include, but are not limited to, issuer credit risk, liquidity risk, market risk, the performance of an underlying derivative financial instrument, formula or strategy. Return of principal is not guaranteed above FDIC insurance limits and is subject to the creditworthiness of the issuer. You should not purchase an investment product or make an investment recommendation to a customer until you have read the specific offering documentation and understand the specific investment terms and risks of such investment.

Neither Asset Allocation nor Diversification guarantee a profit or protect against a loss in a declining market. They are methods used to help manage investment risk.

1IWD the iShares Russell 1000 Value ETF, and QUAL the iShares MSCIA USA Quality Factor ETF outperformed the S&P 500 over 2022

2Source: Koyfin, Bloomberg