Yearly Archive: 2016

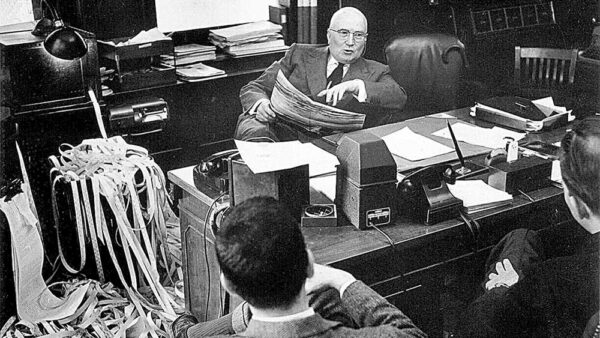

Gerald Loeb’s Strategies For Winning On Wall Street Still Ring True

Market View October 2016: A Disliked Bull Market

WisdomTree Australia Debt ETF Loses Nearly 90% Of Assets In One Day

Trump Correctly Claims We’re In “A Big Fat Ugly Bubble”

The Zero-Forever Bond – The Trick To Make Debt Disappear

BREXIT Not The Calamity Many Predicted – Just As We Thought

Market View July 2016: Brexit – The U.K. votes to leave the European Union

European Central Bank To Begin Buying Corporate Bonds

Bonds Are A “Return-free Risk”

Market View April 2016: 2nd Quarter Outlook

READY TO LEARN ABOUT OUR 30,000 FOOT VIEW OF THE WORLD?

Connect with us to learn more about our in-house investment research and management process.

About Beck Capital Management

Beck Capital Management is an Austin-based fiduciary wealth management and investment firm. We specialize in developing highly personalized investment strategies, working closely with clients to align their financial goals and risk tolerance with our investment practices. Our dedicated team leverages decades of experience, utilizing a data-driven approach to provide tailored solutions that strive to produce financial growth and confidence.

Learn More

Contact Us

- 2009 S. Capital of Texas Hwy Suite 200, Austin, TX 78746

- Phone: 512.345.6789

Investment advisory services offered through Beck Capital Management LLC, a registered investment adviser. Beck Capital Management does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. This site is published for residents of the United States only. Representatives may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed until appropriate registration is obtained or exemption from registration is determined. Not all of services referenced on this site are available in every state and through every advisor listed. For additional information, please contact us.

Links to third-party web sites are provided as a convenience. Beck Capital Management does not endorse nor support the content of third-party sites. By clicking on a third-party link, you will leave this website where privacy and security policies may differ from those practiced by Beck Capital Management.