INDEPENDENCE DAY

We at hope everyone had a great 4th of July weekend, celebrating the United States Independence. We would like to thank everyone who served in one of our military branches, helping maintain our freedom. The United States is the home of the free, because of the brave.

GREECE

Greece has been in the spotlight for many years now due to their dysfunctional economic system. We believe it’s only a matter of time until Greece defaults on its sovereign debt, at some level – either partially or completely. If that happens, it is likely that European countries will have to issue new debt to cover their losses on Greek bonds. In that case, there will be upward pressure on interest rates, especially in the Eurozone, but that same pressure can push U.S. bond rates as well. Rather than independence, Greece seems bent on dependence on other people’s money. In fact, after several years working toward some very minor market-friendly reforms, this past January Greece elected a far-left government which is marching toward socialism by fighting reality… in the name of dignity?

Greece has been in the spotlight for many years now due to their dysfunctional economic system. We believe it’s only a matter of time until Greece defaults on its sovereign debt, at some level – either partially or completely. If that happens, it is likely that European countries will have to issue new debt to cover their losses on Greek bonds. In that case, there will be upward pressure on interest rates, especially in the Eurozone, but that same pressure can push U.S. bond rates as well. Rather than independence, Greece seems bent on dependence on other people’s money. In fact, after several years working toward some very minor market-friendly reforms, this past January Greece elected a far-left government which is marching toward socialism by fighting reality… in the name of dignity?

In a show of disarray the government called for a July 5th vote on whether to accept the IMF/Eurozone/ECB (“troika”) bailout offer which would require spending and pension cuts. What many Greek pensioners might not realize is that whether they accept the troika bailout or not, cuts will come in either case. If Greece leaves the Euro and returns to their own drachma, pensions will be paid in drachmas – the near equivalent of Monopoly money.

Prime Minister Alex Tsipras convinced the people that a “No” vote would strengthen his negotiating stance. That, itself, implies a desire to stay in the EURO, but I see little chance that can happen now – or at least as a full member. However, Tsipras is negotiating in a manner, making last minute changes, which make one wonder if he really wants to be kicked out of the Euro.

How can Germany and other responsible nations, or the IMF, now negotiate away part of the Greek debt? That is what Tsipras hopes to achieve, but should the IMF, Germany, et al, agree to debt forgiveness; wouldn’t Italy, Spain, Portugal and others be tempted to threaten to leave the Euro so they too might erase half their debt? If there is the possibility of contagion, I would argue that it is by allowing debt erasure.

Regardless of the ultimate outcome, the Greek economy makes up only 2% of the Eurozone and 0.39% of the world’s GDP. The problem is causing short-term volatility in world markets, but we believe the ultimate outcome is most dire for the Greek people.

U.S. ECONOMIC OUTLOOK

Due to unusually heavy snowfall and a west coast port strike, along with a skyrocketing dollar, the 1st quarter GDP was slightly negative and got off to a slow start. However, recent economic statistics indicate the second half of Q2 and the rest of the year will have 3%+ GDP. Strong vehicle sales, rising wages and employment, a stronger housing market and the continued benefit of low energy prices are all bullish signs of growth. The continued strength of the dollar is a headwind for U.S. exports but is benefitting companies who source goods elsewhere and sell them here. Lower gasoline prices benefit us all, but are especially significant for the low-income consumer. We continue to position portfolios to benefit from these trends.

THE FED & INTEREST RATES

While Greece is a tiring and an overplayed topic, so is the speculation about the Fed and when they will raise short-term interest rates. Fed Chairwoman, Janet Yellen, and a majority of the Board of the Federal Open Market Committee, have held the Fed Funds rate near 0% for over 6 years, much too long in our opinion. As such, many investors are significantly underestimating the impact of rising rates on bonds, and especially bond funds, bond ETFs and target-date funds. Many investors believe history is future and since 1981 interest rates have declined and investors have been conditioned to believe that bonds provide a “risk-free return”. But today, rates are very low and are likely to rise – an environment in which bonds may surprise many by providing a “return-free risk” instead.

Some bemoan an upcoming Fed rate hike will be a dagger in a bloated stock market. We disagree. We believe the “bubble” is in bonds, not in stocks. In 2007 there was less than $1Trillion in bond funds and bond ETFs. There is now over $2.7 Trillion. That is such a large number that there are almost no buyers left. When rising interest rates finally prick the bond bubble, fund managers will be desperate to sell bonds to satisfy a tidal wave of bond fund shareholders who will be scrambling for redemptions like Greeks at an ATM. Bond math gets thrown out the window when the supply of bonds for sale greatly outstrips the demand for purchase. We saw this at the end of 2008 and early 2009 when we bought many high quality bonds at significant discounts. If this does not occur before, we expect it will as Europe and then Japan, approach the end of their respective QE (Quantitative Easing) programs in September ’16. When that time comes, you can expect that we will be buying investment grade bonds at significant discounts again.

IS THE MARKET OVER-VALUED?

P/E (price to earnings) ratios can be useful when comparing similar companies, say Pfizer and Merck, but the ratio is often misused as if it alone measured the risk of a company or a market. The basic problem with P/E ratios is people forget there are two variables, price and earnings, and the ratio tells you where you are, not where you are going. Low P/E ratios often indicate a bargain, but sometimes low P/E’s are a sign that prices have dropped ahead of dropping earning, and prices will continue down. In 1935 (I imagine) buggy whip manufacturers looked like bargains as the share price dropped but earnings continued falling as more people chose to purchase automobiles – making the buggy whips a classic value trap. At years end in 1928 and 1929 the market was at very low P/E’s and we all know how that went. And at the end of 2008, the S&P had a market P/E over 60, yet the following years provided excellent returns. P/E’s, like other measurement tools must be considered like the independent variables they are. Point is that the P/E of a stock or a market is just one measure – sometimes it is valuable input and sometimes not. Don’t let someone try to convince you that a 17 or 18 P/E on the S&P 500 makes it fully valued or over-valued or under-valued. It depends on where earnings are headed.

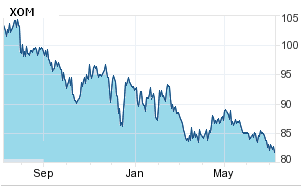

The other assumption of an over-valued market would be that you own every sector of the market. Some sectors have very low P/E’s and others have very high ones. If you were to choose on P/E alone, last fall when oil had dropped to $80/barrel, you would have loaded up on oil companies – a bad idea when oil is oversupplied and prices are dropping (see chart of Exxon).

One must look at what is going on – the 30,000 foot view as we refer to it, to determine whether earnings are likely to rise or fall, as earnings almost always are the ultimate determiner of price.

ASTROTECH (ASTC)

Since this is a small company that we have owned for a couple of years and many of you are not that familiar with what they do, I want to share with you some background and some notes I took at the shareholder meeting last week in Webster, TX (just outside of NASA).

Astrotech sold its satellite launching and International Space Station (ISS) shuttle businesses to Lockheed Martin, last September, for $61Million. Lockheed will pay the final $6M this September raising Astrotech’s cash to over $40 Million ($2/share in cash on a $2.50 priced share).

ASTC is now focused on its subdivision, called 1st Detect, which has numerous patents on a shoebox sized mass spectrometer. Original funding came from NASA who wanted a small mass spectrometer to use on the ISS. In case you are not familiar, a mass spectrometer is used to analyze the mass and relative concentration of atoms and molecules of a sample, which is “sniffed”. It can be used to sniff milk on a production line, immediately alerting if there is a problem or telling the producer how many days before it spoils. Or it may be used on a drone and flown high above smoke stacks to determine what is being manufactured below, or in hospitals to check the breath of an unconscious person to determine if there has been a heart attack of some other problem, to determine the type of poison in a small child, etc. Several government agencies such as the military, TSA, and DEA are interested for bomb or drug detection.

Astrotech hired many NASA engineers with expertise in mass spectrometry, to design and develop the 1st Detect mass spectrometer over the past seven years. It is now available for sale and should be available at large quantities later this year. Theirs is not only portable and cost about $50,000 (typically mass spectrometers are very expensive, $300k to $2M and are very large and heavy, 400 to 2,000 pounds), but it is capable of state-of-the-art analytics and has a refresh time of a few seconds versus the more typical 45 minute to several hours between samples.

At the shareholder meeting, I found that Astrotech has received a $10M contract from the military to “ruggedize” the machine for field use. That is allowing ASTC to make improvements  which are also helpful on factory floors. It already has a meantime between failure of over 5 years and is now running 24/7 to test. Deliveries are expected by November 1st, with customer(s) in hand now and ASTC will present at the GCC convention in late October, expecting to meet with 400 to 500 potential customers, each of which could possibly utilize from a few to a few thousand units.

which are also helpful on factory floors. It already has a meantime between failure of over 5 years and is now running 24/7 to test. Deliveries are expected by November 1st, with customer(s) in hand now and ASTC will present at the GCC convention in late October, expecting to meet with 400 to 500 potential customers, each of which could possibly utilize from a few to a few thousand units.

In addition to sales, there is also a plan for recurring income by leasing units with real-time analytics, as many companies, such as pharmaceuticals and semi-conductor fabricators, prefer to lease and receive the instant analytics. We still expect this stock to go much higher, but it may be another six to nine months before enough sales are reported to propel the price. In the meantime, please understand that the small trading volume will push the price high and low, but we do expect very good results from this company.

Sincerely,

The Beck Capital Team

Copyright Warning and Notice: It is a violation of federal copyright law to reproduce all or part of this publication or its contents by any means. The Copyright Act imposes liability of up to $150,000 per issue for such infringement.

Disclosure: Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Frank Beck & Beck Capital Management explicitly disclaims any responsibility for product suitability or suitability determinations related to individual investors. The investment products discussed herein are considered complex investment products. Such products contain unique risks, terms, conditions and fees specific to each offering. Depending upon the particular product, risks include, but are not limited to, issuer credit risk, liquidity risk, market risk, the performance of an underlying derivative financial instrument, formula or strategy. Return of principal is not guaranteed above FDIC insurance limits and is subject to the creditworthiness of the issuer. You should not purchase an investment product or make an investment recommendation to a customer until you have read the specific offering documentation and understand the specific investment terms and risks of such investment.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.